nassau county tax grievance lawyers

11 Broadway Suite 1155 New York NY 10004. No other tax grievance firm is run by an attorney who previously served as both Nassau Countys Board of Assessors and as a member of the Assessment Review.

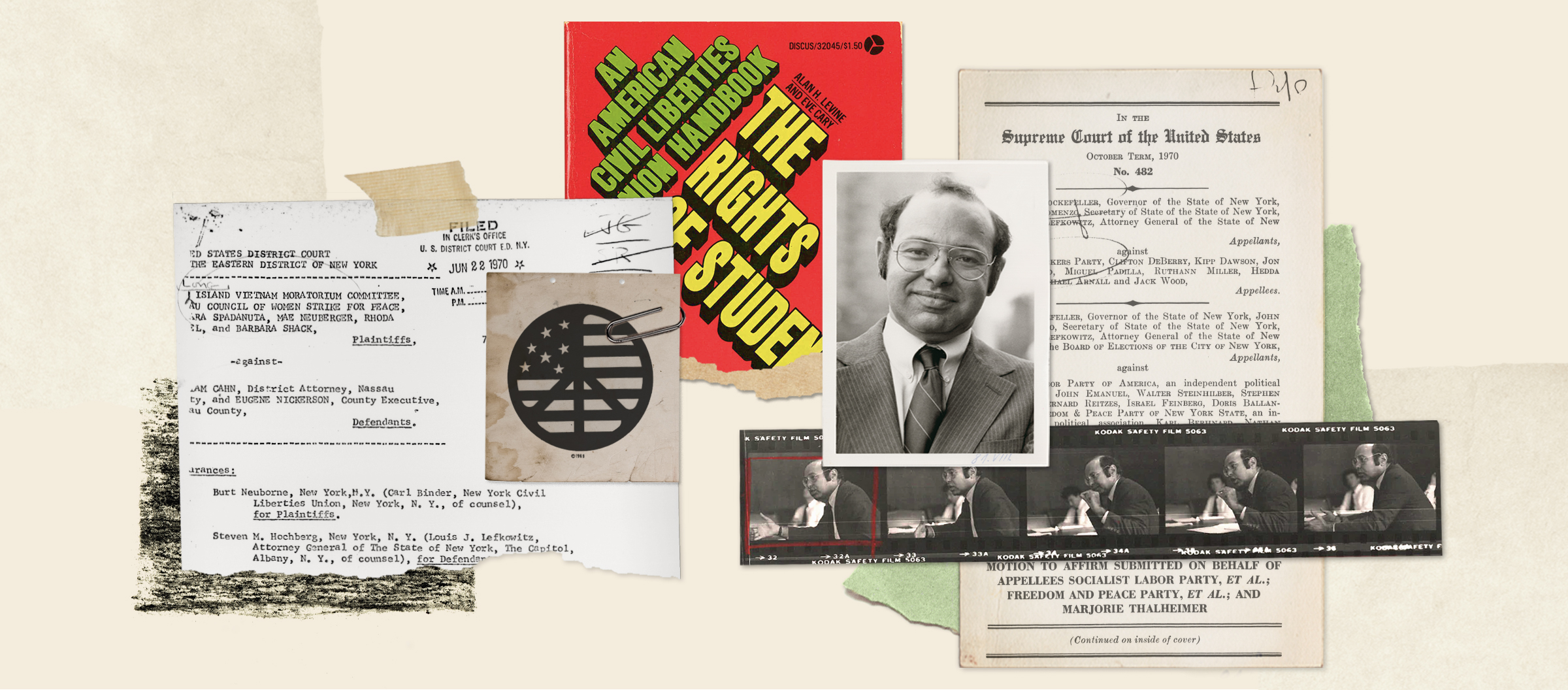

Just Another Day At The Office American Civil Liberties Union

New York City residents.

. Shalom Maidenbaum and his team have been successfully helping Nassau County Long Island taxpayers maintain a fair. Fees can run to. Click to request a tax grievance authorization form now.

This is the total. TALK TO AN EXPERT NOW. One of our real estate attorneys or tax reduction experts at Schroder Strom will do a telephone intake with you.

Deadline for filing Form RP-524. Is there a fee to file a grievance with arc. New York Law School.

New York City Tax Commission. Appeal your property taxes. 518 434-1935 800 442fund.

LIGHTHOUSE TAX GRIEVANCE CORP. 119 Washington Avenue Albany. PAY MY BILL GET STARTED.

Our main objective is to minimize our clients property tax assessment with personalized service. Between January 3 2022 and March 1 2022 you may appeal online. However the property you entered is.

We are one of the leaders in property tax challenges on Long Island. You can fill out a form to get started or just talk to an experienced property tax. You may file an online appeal for any type of property including commercial property and any type of claim.

Blakeman and at the direction of the Legislature ARC will be granting a 60 day grace period extending our 23-24 Grievance Filing. No other tax grievance firm is run by an attorney who previously served as both Nassau Countys Board of Assessors and as a member of the Assessment Review Commission. At the request of Nassau County Executive Bruce A.

Let Lighthouse Guide Your Way to Bigger Savings. 212 233-0580 403B CENTRAL AVENUE. Get local legal help for your Property Tax issues.

Nassau County NY Tax Law Lawyer with 39 years of experience. Your Friendly Neighborhood Property Tax Reducer. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863.

Goldburd McCone LLP assists clients in the Nassau County New York area. Nassau County Assessment Review Commission. Tax and Real Estate.

LOWER YOUR PROPERTY TAXES WITH MAIDENBAUM. Heller Consultants Tax Grievance specializes in grieving property taxes on Long Island for both Suffolk and Nassau counties saving homeowners thousands.

Tax Certiorari Condemnation Mccarthy Fingar Llp

Find Top Nassau County Ny Property Tax Lawyers Near You Lawinfo Attorney Directory

Legislator Holds Online Tax Grievance Workshop Syosset Advance

Property Tax Guardian Posts Facebook

Herald Voter S Guide 2015 By Richner Communications Inc Issuu

Nassau Tax Grievance Firms That Pushed For Changes Donated To Politicians Increased Fees By Millions Newsday

Nassau Residents To Grieve Taxes Again With Tax Roll Freeze Gop Mineola Ny Patch

About Us Long Island Debt Lawyers Debt Solution Attorneys Using Bankruptcy Foreclosure Modification And Negotiation Options Long Island Bankruptcy Foreclosure Law Firm

News Articles Nassau County Women S Bar Association

Nassau Residents Express Confusion Over County S Tax Grievance Response Letters

Community Service Wisselman Harounian Associates

Tomorrow Is The Last Day To Grieve Your Nassau Property Tax Assessment

Nassau County Reassessment Prompts Barrage Of Political Mailers Newsday

Nassau Tax Grievance Firms That Pushed For Changes Donated To Politicians Increased Fees By Millions Newsday

Deadline For Tax Grievance In Suffolk County Is May 16 2023

:quality(70)/d1hfln2sfez66z.cloudfront.net/03-16-2022/t_9033ea57baaa47e38c18606850a71aaf_name_file_960x540_1200_v3_1_.jpg)

Nassau County Attorney Mike Mullin To Resign After State Investigation Action News Jax

Tax Certiorari Petition Tax Settlement 11832 17 18 Pet April 05 2018 Trellis